Business

Pepecoin Skyrockets to New All-Time High Amidst ETH ETF Frenzy

Pepecoin recently experienced a significant rally, riding the wave of broader market movements, specifically the surge in interest and investment in meme coins, to reach a new all-time high (ATH) on May 21.

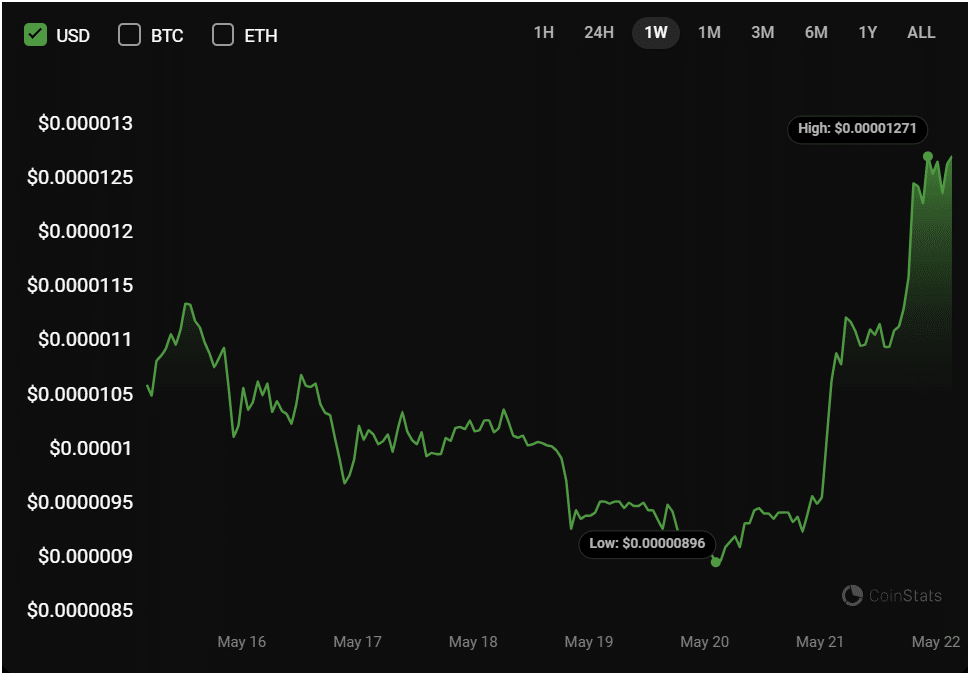

After being a favourite among traders during March’s memecoin mania and subsequently trading sideways, PEPEcoin’s price began to climb on May 20, demonstrating its resilience in the face of market volatility. This upward momentum continued into May 21, with the token’s price surging by more than 46%, reaching $0.0000129 on May 21.

Bears Move In as PEPE Hits ATH

As is typical for cryptocurrencies reaching new ATHs, profit-taking bears stepped in, and PEPEcoin was no exception. The token struggled to maintain its position above $0.0000129, leading to a pullback.

If the sell-off continues, PEPEcoin’s price could decline to the 0.382 Fibonacci support level near $0.00001. Failing to stay above this support level could undermine investor confidence, potentially pushing PEPE’s price down to test the 50-day Exponential Moving Average (EMA) support near $0.0000082.

The 50-day EMA is a popular technical indicator that shows the average price of an asset over a 50-day period, and it is often used to identify potential support or resistance levels.

Potential for Further Gains

Conversely, if PEPEcoin’s price continues to rise, it could rally to the resistance near $0.000014. Overcoming this immediate resistance would allow the memecoin to target the resistance near $0.000018 before possibly correcting it.

Additionally, the relative strength index (RSI) for Pepecoin became overbought following its recent rally, scoring 74.56 on the daily charts. The RSI is a momentum indicator that measures asset price movements to identify overbought or oversold conditions.

Overbought RSI levels, which indicate that an asset’s price has risen too far and too fast and may be due for a correction, and upward-moving average trendlines indicate a strong presence of bulls in the market. However, traders often view an overbought RSI level as a bearish signal, as it usually precedes a bearish reversal or consolidation phase for the asset.

Drivers Behind PEPEcoin’s Surge

One of the main drivers behind PEPEcoin’s recent price increase was the hype surrounding Ethereum. Ethereum’s price surged to $3,800 on speculation about the potential approval of a Spot ETH ETF.

As a meme coin built on the Ethereum blockchain, PEPE benefited from the spillover effect of Ethereum’s bullish momentum.

This phenomenon wasn’t isolated to PEPE; other meme coins like Shiba Inu (SHIB) and Dogecoin (DOGE) also saw price increases as traders sought to capitalize on the overall bullish sentiment in the crypto market.

Traders have been strategically using meme coins as proxy bets on the growth of Ethereum and other major cryptocurrencies, a trend that has been particularly evident since late February. This is a result of bullish demand for ETH rising steadily due to these regulatory expectations, demonstrating the informed and strategic approach of these traders.